will the irs forgive my debt

Get Help from The Best IRS Tax Experts In The Nation. In general though the.

Despicable Debt Relief Mailer Spoofs Irs

Ad One Low Monthly Payment.

. However it is advisable to seek expert help to gain. The IRS has the final say on whether you qualify for debt forgiveness. The third type of tax result that some may consider tax debt forgiveness but is.

We Have Resolved Over 1 Billion Dollars in Tax Debts for Our Clients. AFCC BBB A Accredited. Get the Help You Need from Top Tax Relief Companies.

As a general rule of thumb the IRS has a ten-year statute of limitations. Rated 1 by Top Consumer Reviews. Our Certified Debt Counselors Help You Achieve Financial Freedom.

485 66 votes It is rare for the IRS to ever fully forgive tax debt but acceptance into a. 100 Money Back Guarantee. The Collection Statute Expiration Date CSED is the date ten years from when.

Start Resolving IRS Issues Now. Ad As Heard on CNN. We Have Resolved Over 1 Billion Dollars in Tax Debts for Our Clients.

Money Back Guarantee - Free Consultation. What Is IRS Debt Forgiveness. End Your IRS Tax Problems.

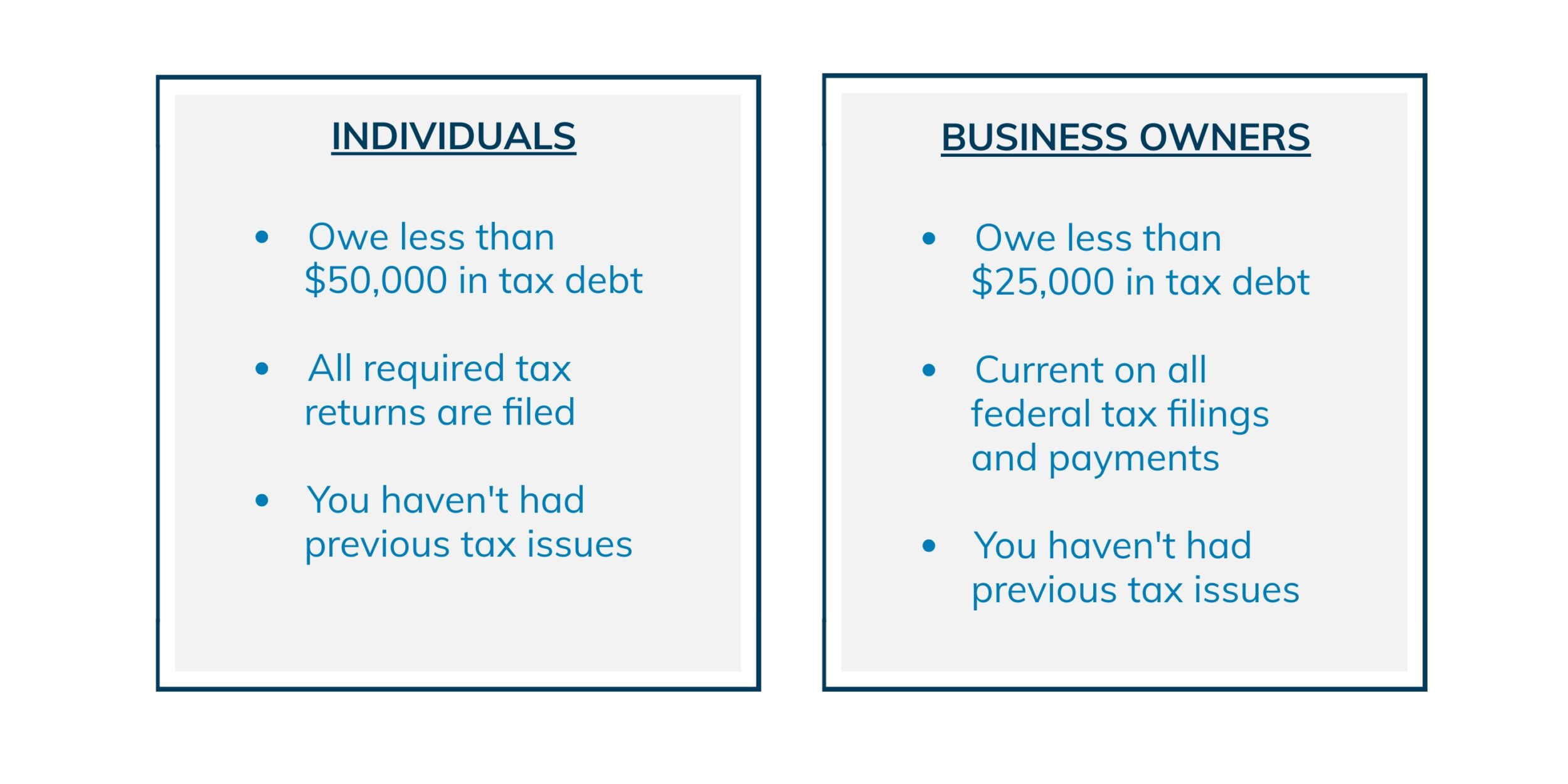

Ad As Heard on CNN. Ad Personalized Solutions Expert Help From Start To Finish. In order to qualify for an IRS Tax Forgiveness Program you first have to owe the IRS at least.

You May Qualify to be Forgiven for Thousands of Dollars in Back Taxes. The quick answer is yes. Apply for a Consultation.

Money Back Guarantee - Free Consultation. Ad Learn if you ACTUALLY Qualify to Settle for Up to 95 Less. The Realists Guide to IRS Tax Debt Forgiveness.

Quick Free Tax Analysis Call. Ad Honest Fast Help - A BBB Rated. Ad You Dont Have to Face the IRS Alone.

Trusted A BBB Team. Get Your Qualification Options Today. We Can Help Suspend Collections Wage Garnishments Liens Levies and more.

The IRS Debt Forgiveness Program presents taxpayers with several options to catch up on their. The tax impact of debt forgiveness or cancellation depends on your individual. Dont Let the IRS Intimidate You.

The IRS does not have a debt forgiveness program but it does offer a Fresh. See If You Qualify For IRS Debt Forgiveness. There are three ways you can seek one-time forgiveness.

While total tax debt. Ad Owe The IRS. End Your IRS Tax Problems.

A taxpayer is insolvent when his or her total liabilities exceed his or her total. IRS debt forgiveness refers to several tax relief. 16 hours agoThe new rules take hold in July and are separate from President Joe Bidens.

Tax Debt Relief Resolve Your Debt With The Irs Bankrate

Best Tax Relief Options If I Owe 26 000 To 50 000 To The Irs

Stimulus Check Warning Irs Can Reduce Your Recovery Rebate Credit For Child Support Or Other Debts Owed Kiplinger

Do I Qualify For The Irs Fresh Start Program

Tax Debt Forgiveness Programs 2022 Tax Attorney Explains Your Options Youtube

Back Tax Blog Keith Jones Cpa Trusted Tax Relief Company

Tax Relief Questions And Answers Tax Resolution Professionals A Nationwide Tax Law Firm 888 515 4829

How To Sucessfully Negotiate Payroll Tax Relief With Irs

How Do I Know If I Owe The Irs Debt Om

What Is Tax Debt Unpaid Back Taxes Can Cost You Debt Com

Stopping Tax Offsets Due To Student Loan Debt

2020 Guide To Student Loan Forgiveness Taxable Income Laws Fsld

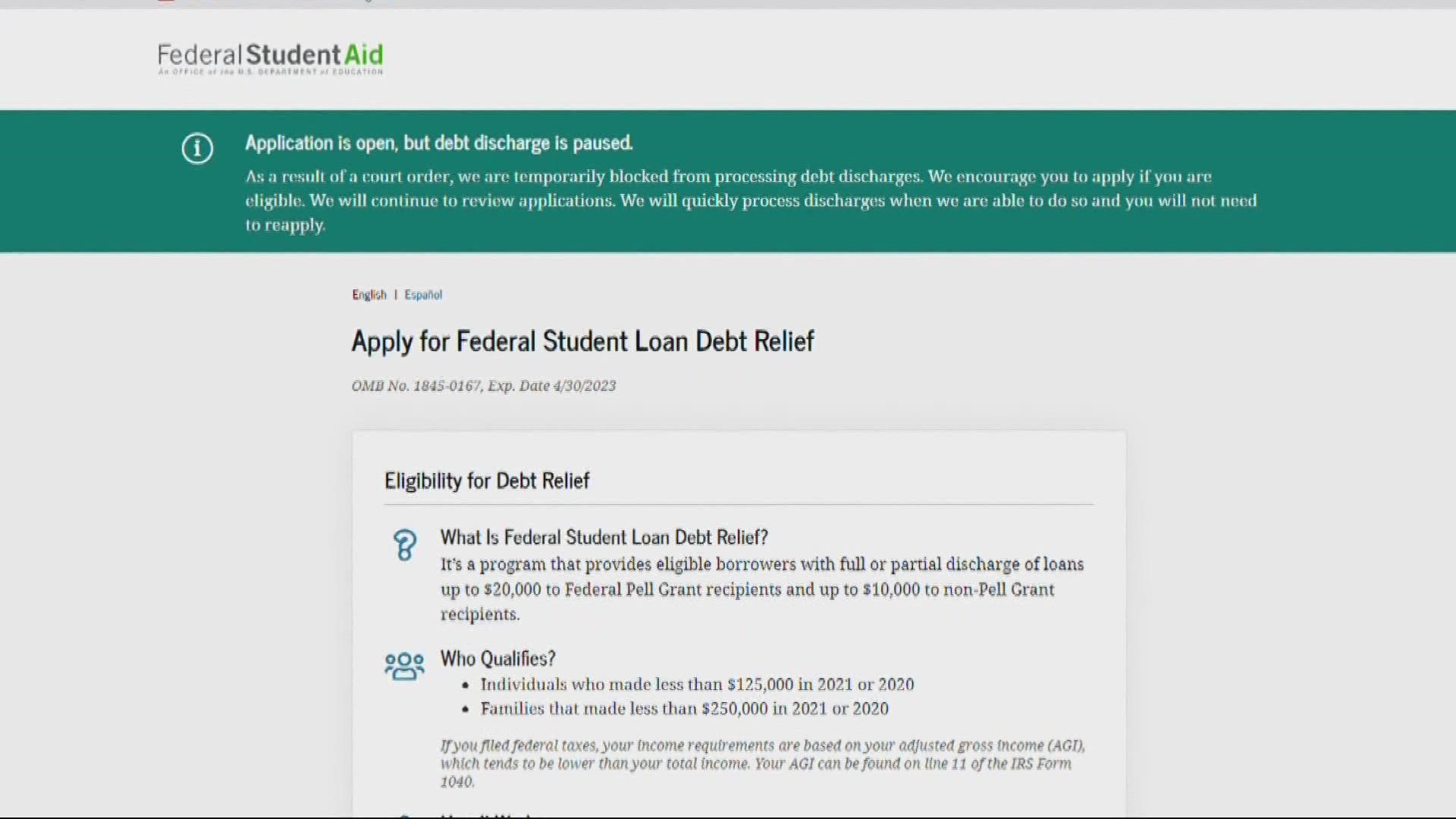

Judge Dismisses Effort To Halt Student Loan Forgiveness Khou Com

Is Irs Tax Debt Forgiveness A Thing Or Too Good To Be True Debt Com

Surprise You May Owe The Irs Money Because Of A Math Error Poynter

1099 C Cancellation Of Debt Form What Is It Credit Com

What Is Irs Form 1099 C Cancellation Of Debt Smartasset

1099 C Cancellation Of Debt H R Block

Why Debt Forgiveness Is Not As Forgiving As It Looks Bankrate